Why Vancouver's Housing Market Hinges on China's Economy

Last week a friend of mine sent me a really fascinating article from The Economist talking about the role of foreign investors in Vancouver's housing market. If you subscribe to The Economist, you can click here to read the article. If you don't subscribe, you'll have to rely solely on what I'm about to say.

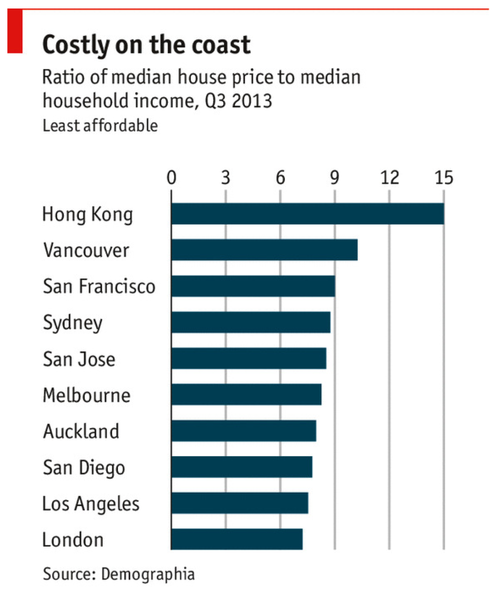

In case you weren't aware, Vancouver is an incredibly expensive city when it comes to real estate. The average price for a single-family detached house is now around C$1 million. By some measures, that makes it the most expensive housing market in North America. Here's a chart that looks at house prices as they relate to household income:

According to The Economist, the median household income in Vancouver is $68,970. This places them 23rd out of 28 in terms of Canada's major cities. So how is it that homes are, on average, selling for $1 million? The locals don't seem to be able to afford them.

Well, it's a well known fact that Chinese buyers continue to be an integral part of Vancouver's housing market. In fact, up until this year, Canada offered a fast track option for citizenship applications if you brought at least $800,000 into the country.

So we know that foreign buyers are having an impact. It's a phenomenon we're seeing in many other cities around the world, such as London. But to what extent is hard to measure—which has forced analysts to get creative.

To try and figure out what percentage of homes are going to foreign buyers, analysts have been looking at macro data, filing through sales records, and even monitoring utility bills to see which homes might be sitting empty.

What they found is that there's a fairly significant correlation between economic activity in China, and Vancouver's housing market. When the Chinese economy does well, so do Vancouver homes. Interesting. Still, that doesn't quantify impact.

When analysts looked for utility bills that would suggest an empty home, they found that only about 8% of high end downtown condos were likely sitting empty. That's a relatively small amount. It could be vacancy rate.

But when they looked for "mainland Chinese-sounding names" on sales records, they found that for homes priced $3M and up, almost 3/4 of the buyers could be from mainland China. Now that's a significant number!

I found this all rather fascinating and I thought you all might as well. It yet again reminds me of how much opacity there is in real estate markets. We're all craving better data. Why else would people be scouring utility bills?